Reimagining Fintech:

Transforming financial services through cloud-native, integrated banking solutions

Addressing the evolving needs of both digital-first and traditional banking institutions

Making finance simple, accessible, and limitless through technology

The power of unified banking.

- A unified approach to technology.

We envision an era where banking services, transformed into commoditized assets within the cloud, mark a departure from expensive, bespoke legacy systems to lighter, more flexible frameworks.

We build and evolve the Kalydos Kenu platform as a configurable, headless, cloud-native, and API-driven solution that is easy to integrate into any infrastructure, creating the opportunity for seamless digital transformations, lending at scale, payments orchestration, and embedded finance for any customer at any stage.

“In today’s complex financial landscape, fragmented systems create friction, increase costs, and slow innovation. Kalydos’ unified ecosystem eliminates these barriers.”

James Dailey, Kalydos CEO

The future is commoditized banking services in the cloud.

The Kalydos platform suite represents the new banking technology paradigm: modular, scalable cloud platforms that transform complex banking operations into plug-and-play capabilities. This commoditization of banking infrastructure through cloud-native, API-first platforms enables even traditional institutions to operate with fintech agility, processing thousands of transactions per second with real-time settlement and automated compliance.

The battle for financial services supremacy is shifting away from who can build the best infrastructure to who can create the most compelling customer experiences on top of these commoditized platforms—a fundamental reshaping of competitive dynamics in the industry.

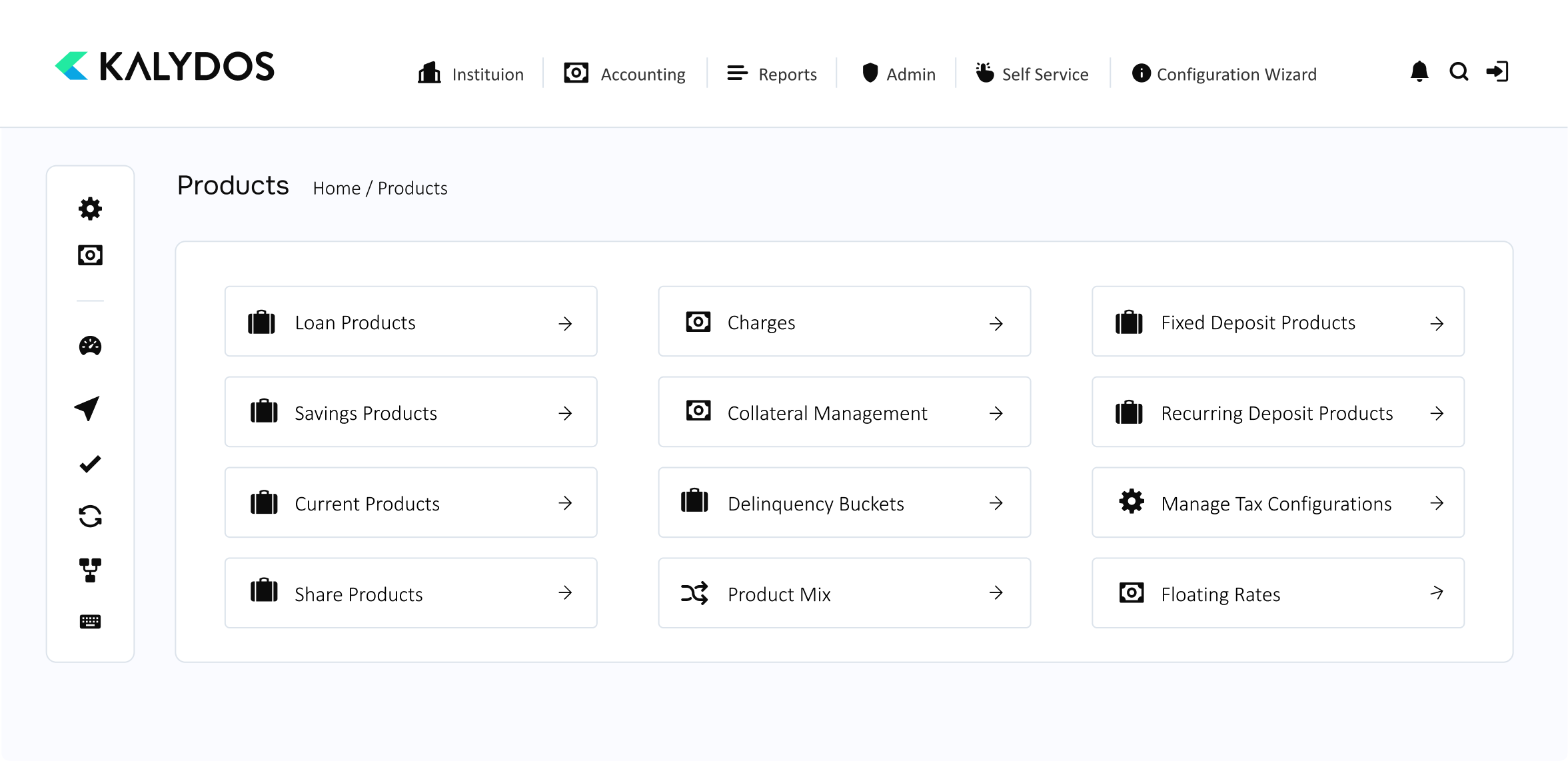

Kalydos Core

Kalydos Core Core Banking Reimagined

Easy to integrate into any downstream system with its API-driven headless architecture, Kenu offers a highly scalable system of records (1,000 write and 8,000 read transactions per second), batch job processing capabilities, an onboarding suite adaptable to any needs (KYC and KYB), a scalable wallet account (5,000 transactions per second), a holistic and comprehensive view of the customer, a notification framework, and a robust lending engine.

Account Services

Loan Management

Process Automation

Kalydos Glide

Kalydos Glide Next-Gen Payment Orchestration

Glide is Kalydos’s modern orchestration engine, scalable, secure, and ISO 20022 compliant. It enables seamless participation in digital payment rails, from instant payments to mobile money to open banking. Beyond its integration capabilities, Glide provides real-time workflow orchestration, payment routing, and data streaming. This deep payment intelligence system enables rapid adaptation to emerging payment technologies and regulatory standards, setting it apart from basic integration offerings.

Seamless Integration

Processing Intelligence

Enterprise Ready

Kalydos Vantage

Kalydos Vantage Lending at Scale

Kalayods’s Vantage is a powerful loan management system built to handle your credit portfolio with exceptional performance and flexibility. This robust solution can process both short-term BNPL loans and long-term interest-bearing installment loans.

Vantage delivers enterprise-grade performance with a scalable architecture supporting 1000 write TPS and 10,000 read TPS, while completing Close of Business processing for 2M loans in under 30 minutes. Key functional features include support for flexible BNPL loans with down payments, multiple disbursement options, and various repayment cycles.

High-Volume Loan Origination

Mass Loan Servicing

Enterprise Ready

What's Next

As we continue to push the boundaries of what’s possible in fintech, our roadmap is focused on enhancing capabilities that matter most to forward-thinking organizations.

Enhance

AI Capabilities

We’re accelerating the development of our AI-driven configuration and insights platform, which will enable financial institutions to deploy sophisticated, data-driven services without extensive technical expertise. This next-generation AI layer will transform how banking platforms adapt to customer needs, optimize operations, and identify new opportunities.

Solidify

Confidential Banking & Security Enhancements

Security remains paramount in everything we build. We’re further investing in our security infrastructure and compliance frameworks, cementing our position as the market’s most secure Kalydos Kenu platform. Our confidential banking initiatives will enable institutions to manage sensitive financial data with unprecedented protection while maintaining the flexibility and speed that define our platforms.

Fraud & AML

Integration Ecosystem

We’re developing a no-code integration framework to connect with any Fraud and Anti-Money Laundering provider seamlessly. This will dramatically reduce implementation timelines and allow our partners to work with their preferred fraud prevention and compliance solutions without compromise.

Shape the Future!

Pioneer the new era of fintech where innovation isn’t constrained by technology. Join the visionaries who are redefining what’s possible in fintech, and help us build the platforms that will power the next generation of breakthrough financial experiences.